First-Time Home Buyers Struggle

The cutthroat home market has frustrated buyers across the country, with many submitting multiple offers only to be outbid again and again. Low …

The cutthroat home market has frustrated buyers across the country, with many submitting multiple offers only to be outbid again and again. Low inventory, high prices and intense competition are challenging for any buyer, but first-timer buyers are facing the highest hurdles.

Their problems finding a home are not defined entirely by this wild pandemic market. First-time buyers have built-in challenges. Consider their financial picture: Generally younger, they lack a deep credit history, which could mean lower credit scores. Their employment history is shorter and their income is typically lower than that of older, more established bidders. First-timers also have had less time to save for a deposit and an emergency fund. All of this leaves them less competitive in bidding wars, less likely to secure a loan, and less appealing to sellers.

The pandemic has magnified those challenges, according to NerdWallet’s First-Time Home Buyer Metro Affordability Report, which examined the state of the market for this cohort in the 50 largest U.S. cities during the second quarter of 2021.

During that period, the number of available listings actually improved from Q1 by 2 percent in those 50 cities, but fell 5 percent across the nation. In prepandemic years, larger first- to second-quarter upticks in listings were the norm. (In 2018 they were up 10 percent; in 2019, 6 percent.) A better comparison may be year over year: Measured that way, Q2 inventory is down 48 percent from Q2 2020.

But it’s the rising prices (the result of shrinking supply and swelling competition) that have really hurt first-timers. A general formula used to determine affordability multiplies income by three — so if you earn $100,000, you can probably qualify to buy a $300,000 home. But in the 50 cities studied, list prices were, on average, 5.5 times the local median income of first-time buyers, leaving most homes out of reach.

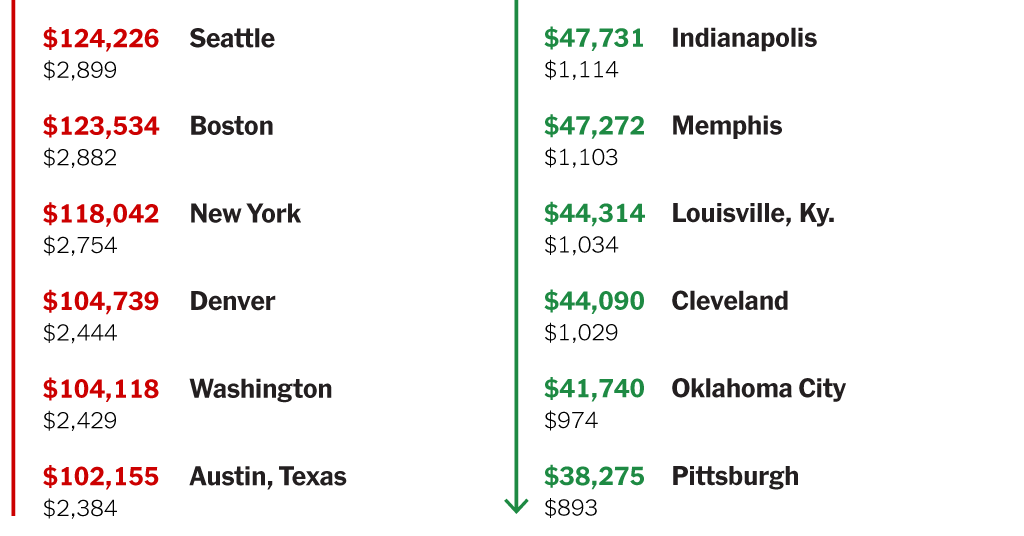

This week’s chart, using data from NerdWallet’s study, shows the 10 most affordable and 10 least affordable cities for first-timer buyers among those 50 cities, ranked by using the affordability ratio in each city.

For weekly email updates on residential real estate news, sign up here. Follow us on Twitter: @nytrealestate.